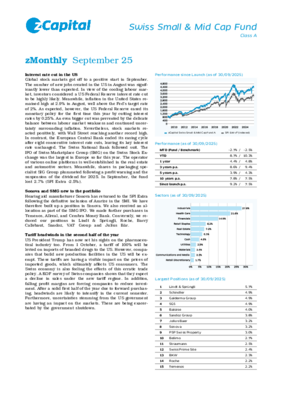

Monthly report September 2025 of the zCapital Swiss Small & Mid Cap Fund (class A)

In September, the fund lost 2.7% (SPI Extra -2.5%). We have built up a position in Sonova and SMG. We made further purchases in Temenos, Allreal, and Cembra Money Bank. Conversely, we reduced our positions in Lindt & Sprüngli, Roche, Barry Callebaut, Sandoz, VAT Group and Julius Bär.

The US Federal Reserve eased its monetary policy for the first time this year, as expected. An even bigger cut was prevented by the delicate balance between labour market weakness and continued uncertainty surrounding inflation. Nevertheless, stock markets reacted positively, with Wall Street reaching another record high. In contrast, the European Central Bank ended its easing cycle, leaving its key interest rate unchanged. The Swiss National Bank followed suit.

Tariffs are having a visible impact on the prices of imported goods, which ultimately affects US consumers. The Swiss economy is also feeling the effects of the erratic trade policy. After a solid first half of the year due to forward purchasing, headwinds are likely to intensify in the current semester. Furthermore, uncertainties stemming from the US government are having an impact on the markets. These are being exacerbated by the government shutdown.