Monthly report November 2025 of the zCapital Swiss ESG Fund (class A)

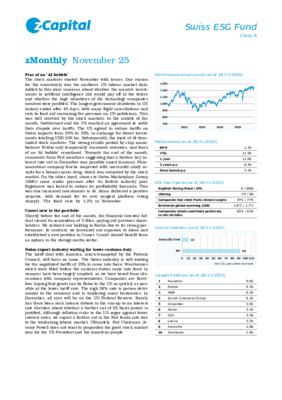

The fund rose by 1.2% in November. We received payment for the U-Blox shares. We reduced our holding in Roche. In contrast, we increased our exposure to Alcon and established a position in Comet.

The stock markets started November with losses. One reason for the uncertainty was the mediocre US labour market data. The longest government shutdown in US history ended after 43 days. This was well received by the stock markets. In the middle of the month, Switzerland and the US reached an agreement to settle their dispute over tariffs. Subsequently, the topic of AI dominated stock markets. Nvidia's strong results only provided temporary reassurance. Tensions were eased by comments from Fed members suggesting that a further key interest rate cut in December was possible.

The much-trumpeted tariff deal with America still has an issue to face. The Swiss industry is still waiting for the negotiated tariffs of 15% to come into force. In December, all eyes will be on the Fed. Although inflation risks in the US argue against lower interest rates, we expect a further cut in the Fed funds rate due to the weakening labour market. Ultimately, Fed Chairman Powell does not want to jeopardise the good stock market year for the US President and the American people.